The Ultimate Guide to Understanding Gold Price

Gold has been a valuable and sought-after precious metal for centuries. Its unique properties, such as its rarity, durability, and beauty, have made it a symbol of wealth and power throughout history. The price of gold is a topic of great interest and importance for investors, economists, and individuals alike. In this comprehensive guide, we will delve into the factors that affect the price of gold, examine its historical trends, analyze the current gold price, discuss the opportunities and risks of investing in gold, and provide a forecast for its future price. Whether you are a seasoned investor or someone looking to understand the dynamics of the gold market, this guide will equip you with the knowledge and insights you need to navigate the world of gold price.

“You may also be interested in Ancient Gold Mining Methods“

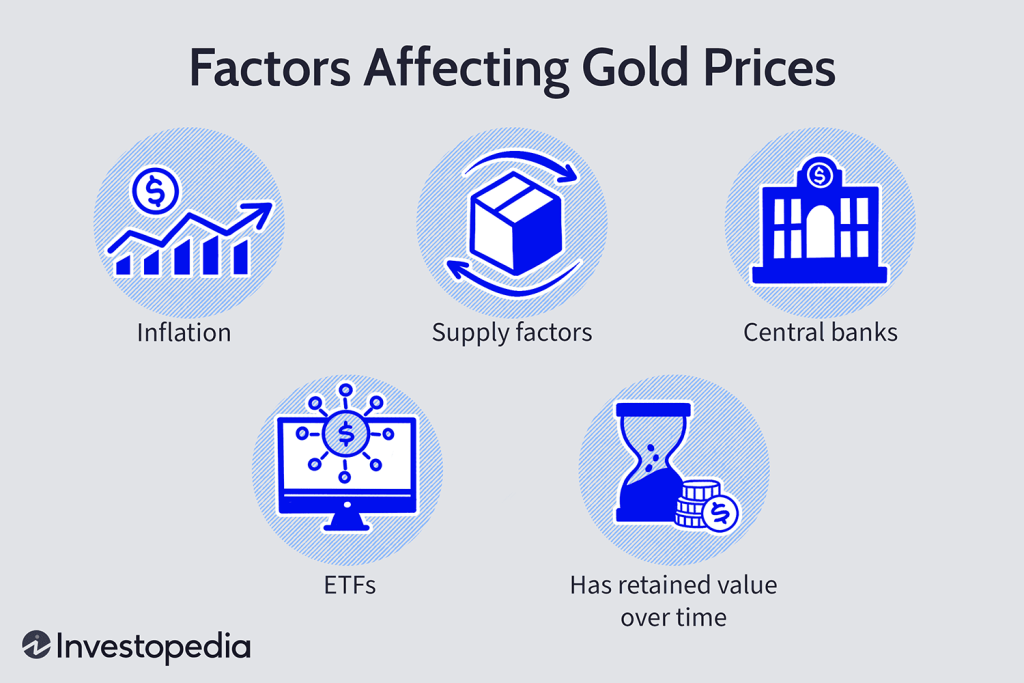

Factors Affecting Gold Price

Demand and Supply: The demand and supply of gold play a significant role in determining its price. When the demand for gold exceeds the available supply, the price tends to increase. Conversely, when the supply of gold exceeds the demand, the price may decrease.

Inverse Relation with Fiat Currencies: Gold and fiat currencies have an inverse relationship. When the value of fiat currencies, such as the US dollar, decreases, the price of gold tends to rise. This is because investors view gold as a safe haven asset during times of currency devaluation.

Safe Haven Asset: Gold is often considered a safe haven asset, meaning it is seen as a reliable store of value during times of economic uncertainty. When there is volatility in the stock market or geopolitical tensions arise, investors tend to flock to gold, driving up its price.

Inflation: Gold is often used as a hedge against inflation. When inflation is high, the purchasing power of fiat currencies decreases, leading investors to seek alternative assets like gold. As a result, the demand for gold increases, causing its price to rise.

Interest Rates: Interest rates can also impact the price of gold. When interest rates rise, investors may sell their gold holdings to invest in other assets that offer higher returns. This can lead to a decrease in the demand for gold and a subsequent decrease in its price.

Geopolitical Events: Geopolitical events, such as wars, political instability, or trade disputes, can have a significant impact on the price of gold. During times of uncertainty, investors often turn to gold as a safe haven, driving up its price.

Mining Production: The supply of available gold is influenced by mining production. If there is a decrease in mining production, the supply of gold may decrease, leading to an increase in its price. Conversely, an increase in mining production can result in a higher supply of gold and potentially lower its price.

Historical Trends of Gold Price

Gold prices have fluctuated over the past century, reaching lows in the 1970s and inflation-adjusted highs in the early ’80s. In recent years, they have… If we look at the historical data, we can see that gold prices have experienced significant changes over time. For example, in 1915, the real (inflation-adjusted) gold price per ounce was…

During the 1970s, gold prices hit a low point due to economic stability and the end of the Bretton Woods system. However, in the early 1980s, gold prices reached an all-time high… Since then, gold prices have continued to fluctuate based on various factors such as economic conditions, geopolitical tensions, and investor sentiment…

It is important to note that gold prices are influenced by both short-term and long-term trends. For example, during times of economic uncertainty or market volatility, investors often turn to gold as a safe-haven asset, driving up its price… On the other hand, when the economy is performing well and there is confidence in the financial markets, gold prices may decrease as investors shift their focus to other investment opportunities…

Overall, understanding the historical trends of gold prices can provide valuable insights for investors looking to make informed decisions about buying or selling gold…

Investing in Gold

Investing in gold can be a lucrative option for investors looking to diversify their portfolio. Gold has long been considered a safe haven asset, providing a hedge against inflation and economic uncertainty. There are several ways to invest in gold, each with its own pros and cons. One option is to invest in physical gold, such as gold bars or coins. This allows investors to have direct ownership of the precious metal. Physical gold can be stored at home or in a secure vault. However, there are costs associated with storage and insurance, and selling physical gold may involve additional fees.

Another option is to invest in gold through exchange-traded funds (ETFs) or mutual funds. These funds hold a portfolio of gold assets and allow investors to gain exposure to the price of gold without owning the physical metal. ETFs and mutual funds are easily tradable and offer liquidity. However, investors should be aware of management fees and the potential for tracking error. Futures and options are also popular ways to invest in gold. These financial instruments allow investors to speculate on the future price of gold without owning the physical metal. Futures contracts require a higher level of expertise and may involve leverage, which can amplify both gains and losses. Options provide the right, but not the obligation, to buy or sell gold at a predetermined price.

When investing in gold, it is important to consider the current market conditions and the long-term outlook for the metal. Gold prices can be influenced by factors such as interest rates, inflation, geopolitical events, and investor sentiment. Conducting thorough research and consulting with a financial advisor can help investors make informed decisions. In conclusion, investing in gold can be a valuable addition to an investment portfolio. It offers diversification and acts as a hedge against economic uncertainty. However, investors should carefully consider the different investment options and their associated risks before making any decisions.

Gold Price Forecast

Gold price forecasts suggest that the price of gold is expected to continue its upward trend in the coming years. According to experts, gold prices are projected to reach $2,500 per ounce by the fourth quarter of 2024 and $2,600 per ounce by the end of 2025. ING, a leading financial institution, anticipates continued strength in gold prices and expects them to average $2,031 per ounce in 2024, with a fourth-quarter average of $2,100 per ounce. This indicates that the upward momentum in gold prices is likely to persist. The Gold Price Forecast website provides valuable insights into the future price of gold. It predicts that gold prices will remain in a range between $2,000 and $3,000 in 2025, with an average figure of $2,498.72. This forecast suggests that gold could potentially reach new all-time highs in the coming years.

The recent record high of $2,532 for gold further supports the positive outlook for its price. Analysts believe that gold has the potential to continue its uptrend, with targets set at $2,566 and beyond. This indicates that there is still room for further gains in the gold market. Investors who are considering investing in gold should take these forecasts into account. The projected increase in gold prices makes it an attractive investment option for those looking to diversify their portfolio and hedge against inflation or economic uncertainties. However, it is important to note that gold prices are influenced by various factors, including global economic conditions, geopolitical tensions, and market sentiment. These factors can cause fluctuations in the price of gold and may impact the accuracy of the forecasts.

In conclusion, the gold price forecast suggests a positive outlook for the precious metal. With projected price increases and the potential for new all-time highs, gold remains an attractive investment option. However, investors should carefully consider the risks and factors that can affect gold prices before making any investment decisions.

In conclusion, understanding the gold price is essential for anyone interested in investing in this precious metal. The factors affecting gold price are numerous and complex, including economic indicators, geopolitical events, and market sentiment. By analyzing historical trends and current market conditions, investors can make informed decisions about buying or selling gold. Investing in gold can be a viable option for diversifying a portfolio and protecting against inflation. However, it is important to consider the risks and drawbacks associated with gold investments, such as price volatility and storage costs. It is also crucial to carefully evaluate the current gold price and forecast future trends before making any investment decisions.

Overall, the gold price is influenced by a wide range of factors, and its value can fluctuate significantly over time. By staying informed and conducting thorough research, investors can navigate the complexities of the gold market and potentially benefit from its long-term value. Whether you are a seasoned investor or a beginner, understanding the dynamics of the gold price is crucial for making informed investment choices.

To view daily gold prices, you can visit gold price